The Ultimate Guide to Buying a Home in Florida

You’ve always dreamed of owning your own home. You know the feeling of coming home to a space that is all yours, where you can make all the decisions and no one will tell you otherwise. It’s time to start looking for the perfect place.

But where do you start? There are so many different types of homes in Florida, so it can be difficult to pick just one. This guide will teach you everything you need to know about Florida real estate. From understanding the market and what you should look out for when buying a new home, to finding a mortgage broker and how to use your homeowners insurance, read on for all the information you need before purchasing a new home in Florida.

Buying a home in Florida, while an exciting and rewarding process, can also be overwhelming. What’s the best area to live in? What are the most important factors to consider when buying a home? Do I need a realtor? Here are some guidelines to make your home buying journey as smooth as possible.

Whether you’re new to Florida or have lived here for years, this guide will help you buy the perfect place for you and your family.

Welcome to the Sunshine State

Florida is the perfect place to buy a home. It’s warm year-round, and has beautiful beaches, bustling cities, and plenty of space for you to make your own. But Florida also has many different regions that offer diverse climates, cultures, and lifestyles. No matter what kind of home or lifestyle you are looking for, Florida has it all.

Florida’s Housing Market

Florida is currently seeing a high demand for housing, with homes being sold at a rate of about 10% higher than the national average. This means that you’ll need to be quick on the draw if you want to get your hands on one of the many properties available.

Florida homes are typically priced anywhere from $300,000 to $500,000 and there are a number of factors that come into play when buying a new home in Florida.

The most important factor is location. You’ll want to make sure you find the right area for your lifestyle and budget.

There are four main regions in Florida: West Coast, Central East Coast, Gulf Coast and Panhandle. Each region has its own pros and cons depending on what you want out of a new home. For example, on the West Coast expect more affordable housing but not as much entertainment or nightlife as in other areas like Miami or Tampa Bay. The Gulf Coast offers great beaches but also high flood risks during hurricane season. And Central East Florida is perfect for retirement communities with easy access to Orlando’s theme parks and warm winters.

Another major factor when choosing a new home in Florida is your budget – there’s no point struggling with affordability once you find an amazing new place! You can work out how much house you can afford by considering your monthly income and expenses (including things like gas prices). It might also help to speak with an agent who knows the local market well and

The Buying Process in Florida

The buying process begins with viewing homes for sale, picking a home to put an offer on, and getting your financing in order. Once you’ve found the perfect home and have negotiated with the seller, you’ll need to conduct a title search to make sure no one else owns any part of the property. This is done by hiring a title company to conduct a title search and report. The next step is securing financing for the home. After that, you will sign all the documents and close on the property.

What You Need To Know About Closing Costs in Florida

Closing costs are the fees associated with the purchase or sale of a home, including loan origination fees, prorated taxes and interest on the mortgage. They can add up to thousands of dollars depending on the price of your home. But there are ways to avoid paying these costs altogether. For example, many lenders offer programs that waive closing costs entirely for military veterans, teachers and first-time homeowners. You might also be able to negotiate with the seller’s agent to have them pay all or some of your closing costs in exchange for a lower purchase price.

The Home Inspection

Once you’ve found the home of your dreams, it’s time for a home inspection. This will tell you about the condition of the home. You should never buy a home without first having it inspected by an expert.

Getting Homeowner’s Insurance in Florida

Homeowner’s insurance is an important part of the home buying process. Your homeowner’s insurance policy helps protect you and your property from the potential risks associated with owning a home.

When you’re trying to buy a new home in Florida, one of the first things you will be asked for is proof of your homeowner’s insurance.

You will need to provide copies of your homeowners insurance as well as any other pertinent insurance policies that protect your property. Your mortgage broker might also ask for a copy during the application process.

It’s important to note that not all homeowner’s insurance policies are created equally. There are different types and levels of coverage available, so it is important to fully understand what you are getting into before signing on the dotted line. If you have any questions about your policy or how it may affect your purchase, contact a reputable company like State Farm Insurance today!

What to Consider When Purchasing a Florida Home

There are a few things to think about when purchasing a new home in Florida. You need to make sure you know your budget and how much you can afford. As well, it’s important to consider what area of the state would be best for you and your family. You should also figure out if you want to buy an existing home, build a new one, or rent.

Florida is full of great communities that are perfect for families of all sizes and stages. The key is figuring out what kind of lifestyle will work best for your family and where you want to live. That way, you can narrow down your options and start looking at homes that match what you need the most.

One good place to start is finding a mortgage broker who can help walk you through the process of getting a mortgage on your desired property. It’s important that your mortgage broker understands the local market and will be able to give impartial advice about mortgages and interest rates in your area. Remember, every mortgage is different so it’s best not to rush into anything before speaking with a broker first!

Tips For New Floridians

Florida is a beautiful place to live. Whether you’ve been here for years or are new to the state, there are a few things you should know.

First and foremost, if you plan on living in Florida long-term, make sure you are prepared. Adapting to the climate can be difficult at first, so it’s best to go into it with some knowledge of what to expect. If you have any medical issues that might require special attention in the Florida climate, make sure your doctor is aware of them so they can provide the necessary care.

If you like to stay active outdoors, there are plenty of opportunities for outdoor activities and adventures at any time of year (especially if you find an apartment with a pool!). You may also want to consider purchasing homeowners insurance as well as other types of insurance–such as auto or health–to protect your belongings from property damage or injury claims.

Finally, if you plan on bringing your car with you from another state, make sure it has an emissions test before entering Florida. Or else face fines and penalties upon arrival!

Who’s Your Southwest Florida Realtor?

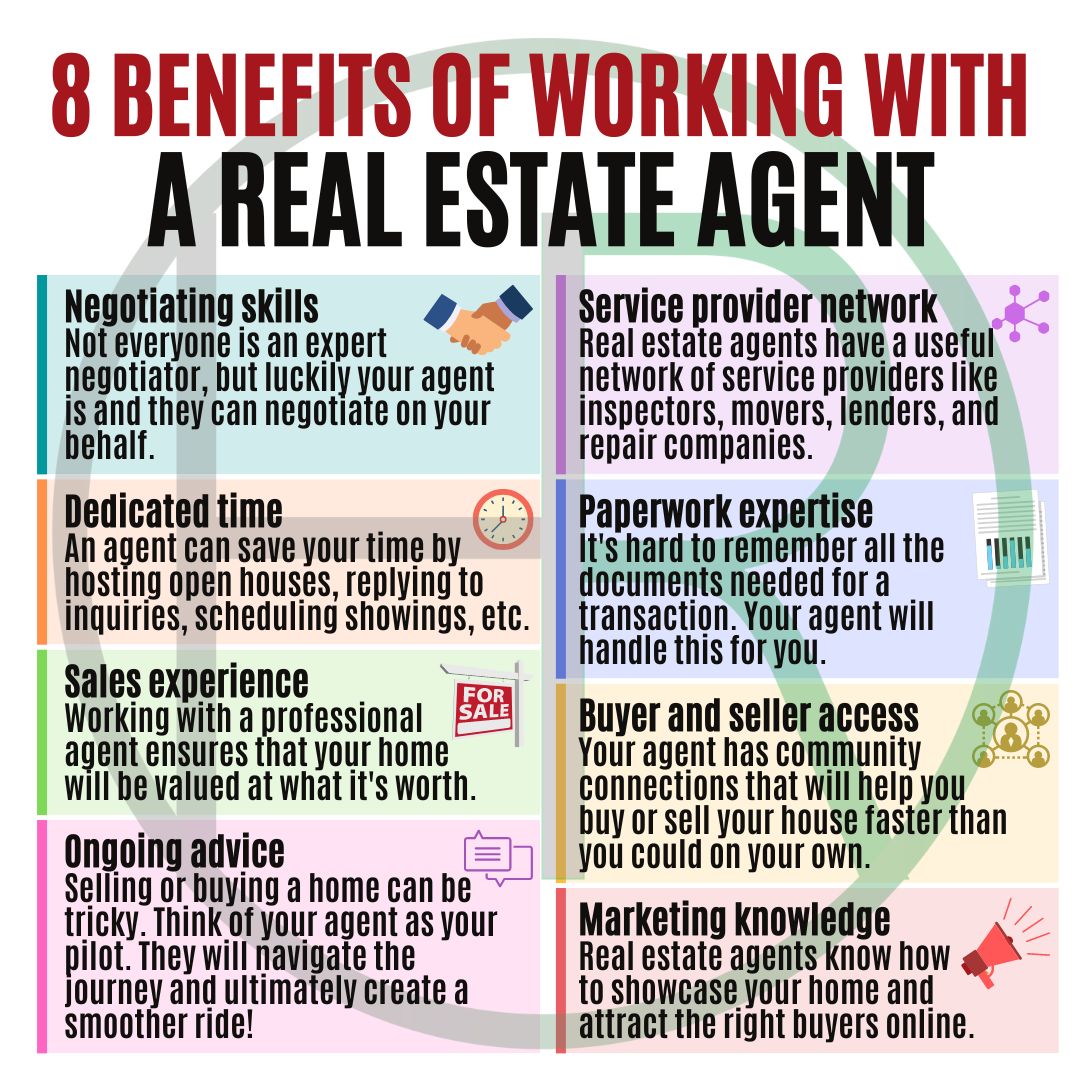

Choosing the right real estate agent can make all the difference in the world. A good realtor will not only help you find a home, but they’ll also teach you about Florida real estate. They can answer all your questions and give you valuable insight into the market. It’s important to find an agent that matches your needs, so take a minute to decide what type of agent you need.

If you have time to shop for homes on your own then full-time agents are perfect for you. Full-time agents are dedicated to helping their clients buy homes and are always willing to answer any questions you may have about real estate.

Retired agents:

Retired agents work with clients throughout their retirement years, which means they’re experienced in everything from home buying to preparing for retirement. Retired agents tend to know the area well which is why they’re often more knowledgeable than full-time agents who may not live in the same city or state as their clients.

Volume sellers:

Most volume sellers only list properties and don’t spend much time with clients–they’re more involved with marketing than anything else. These types of realtors can be useful if you want someone who knows how to list houses fast and meet deadlines, but they won’t go out of their way to help buyers like a full-time agent would.

Buying a Southwest Florida Home in a Sellers Market:

What You Should Know

Southwest Florida is a great place to live. It has beautiful beaches, low crime rates and great schools. But it’s not just the scenery that attracts people to this area – the real estate here is incredible. Southwest Florida is in a sellers market, which means there are many homes for sale and buyers need to act fast if they want to buy one of these properties.

Naples Florida is one of my favorite areas. Naples, Florida is a vibrant and growing city that is well known for its beautiful beaches, world-renowned shopping, and world-famous architecture. The city is also home to a number of high-end real estate properties, making it a popular destination for luxury home buyers and sellers.

The Naples real estate market is experiencing strong growth, with prices rising steadily over the past several years. In 2022, the average home value in Naples was $225,000. This is a significant increase from the $160,000 average home value in 2017, and it is expected to continue to grow in the coming years.

The Naples real estate market is also experiencing strong demand from investors, with many people looking to purchase property in the city for investment or use as a permanent home. This is due in part to the city’s location – just minutes away from both Naples and the Florida Keys. As the city continues to grow, so too will the demand for property in Naples.