The home buying process typically involves the following steps:

Purchasing a home is an exciting and significant milestone in life, but the process can also be overwhelming for first-time homebuyers. To help make the process smoother, it’s important to understand each step involved in buying a home.

- Determine your budget and get pre-approved for a mortgage

- Find a real estate agent and start searching for a home that fits your needs and budget

- Make an offer on a home, which may involve negotiating the purchase price and other terms with the seller

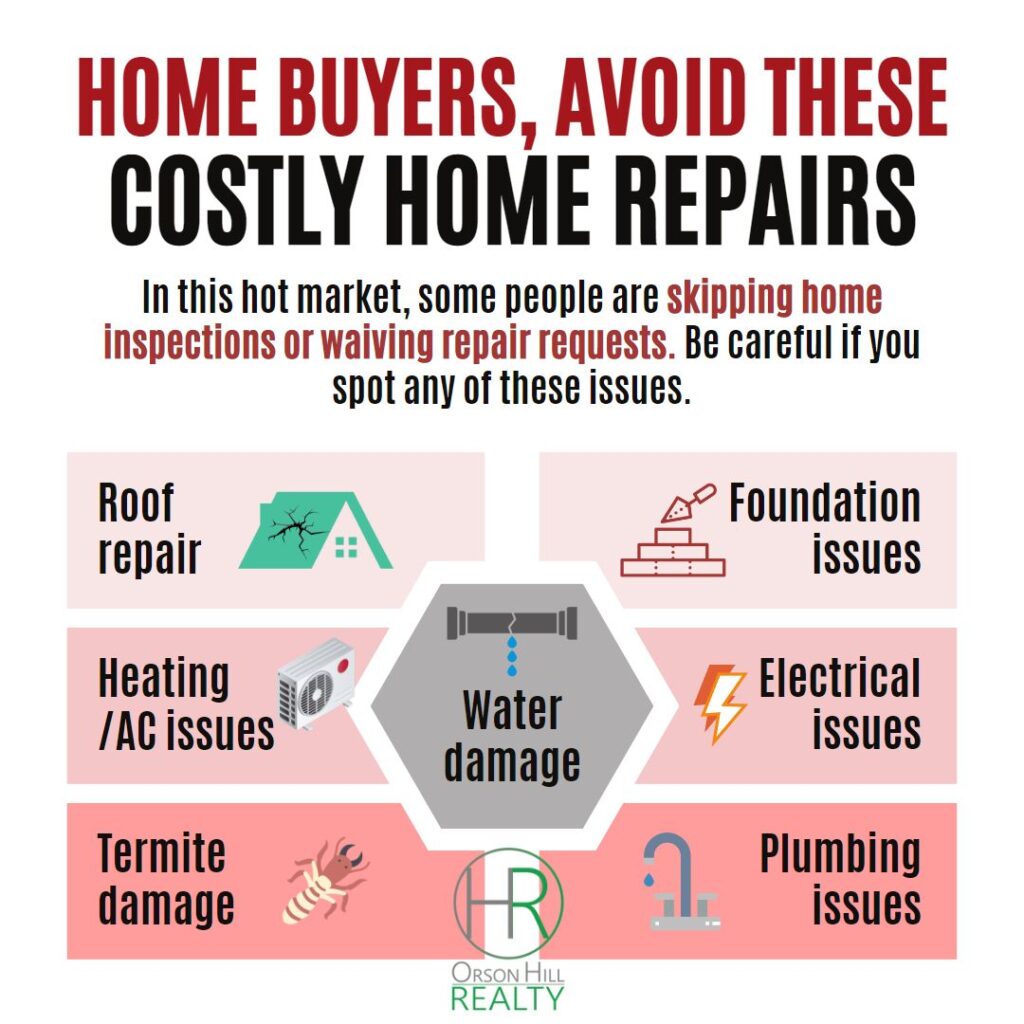

- Get a home inspection to assess the condition of the property

- If the home passes inspection, move forward with the mortgage application process and provide documentation to support your loan application

- Close on the loan, which typically involves signing a lot of paperwork and paying closing costs

- Take possession of the home and move in!

The Home Buying Process: A Step-by-Step Guide

Step 1: Determine Your Budget and Get Pre-Approved for a Mortgage The first step in the home buying process is to determine how much home you can afford. This will give you a clear picture of your budget and help you avoid overspending. To do this, you can use online calculators or consult with a mortgage professional.

Once you have an idea of your budget, you can get pre-approved for a mortgage. This is a preliminary loan approval that verifies your credit score, income, and other financial information to determine what you can afford. This step is crucial as it helps you avoid wasting time searching for homes you can’t afford and gives you a competitive edge when making an offer on a home.

Step 2: Find a Real Estate Agent and Start Searching for a Home Finding a real estate agent you trust is essential to help you navigate the home buying process. Your agent will be able to help you find homes that fit your budget and needs, answer any questions you have, and guide you through the negotiation process.

Start searching for homes by using online search engines and visiting open houses. Make a list of what you like and don’t like about each home and keep a record of all the properties you’ve viewed. This will help you keep track of your search and make it easier to make a final decision.

Step 3: Make an Offer on a Home Once you’ve found a home you love, it’s time to make an offer. Your real estate agent will help you create a written offer that includes the purchase price, closing date, and any other terms you and the seller have agreed upon. This offer is then presented to the seller, who may accept, reject, or counter your offer.

Step 4: Get a Home Inspection A home inspection is a crucial step in the home buying process as it assesses the condition of the property and identifies any potential issues that need to be addressed. This is your opportunity to ensure that the home you’re purchasing is in good condition and to renegotiate the purchase price or other terms if necessary.

Step 5: Mortgage Application and Documentation If the home passes inspection, it’s time to move forward with the mortgage application process. This involves providing documentation to support your loan application, including proof of income, employment, and assets. Your lender will also order an appraisal to determine the value of the property.

Step 6: Close on the Loan Closing is the final step in the home buying process and typically involves signing a lot of paperwork and paying closing costs. Closing costs include fees for services such as title insurance, appraisal, and attorney’s fees. Your real estate agent and mortgage professional will be there to help you understand the paperwork and guide you through the process.

Step 7: Take Possession of the Home and Move In! Congratulations! You’re now a homeowner. Take possession of the keys, inspect the property to make sure everything is in order, and move in!

In conclusion, buying a home is a complex process that requires careful planning and preparation. By understanding each step involved in the home buying process, you can ensure a smooth and successful outcome.