5 Questions to Ask Yourself When You’re Considering Buying a Home or Renting

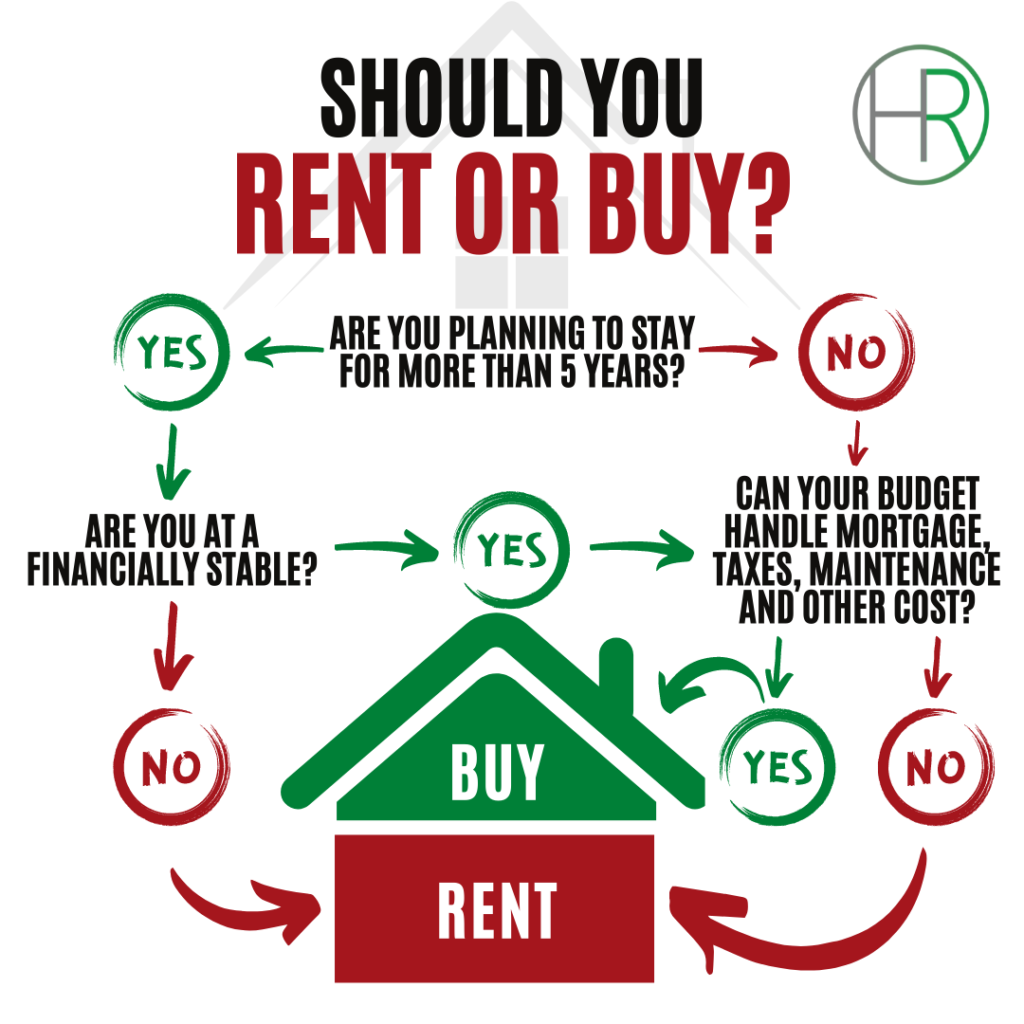

The decision to rent or buy a home is different for everyone. Some people have specific needs that would make renting difficult, while others simply prefer the flexibility of renting vs. owning. Whichever camp you fall into, the key to making the right decision is asking yourself the right questions first. Understanding your personal situation and weighing your options will help you determine whether buying a home makes more sense than renting or vice versa. Below are 5 questions to ask yourself when you’re considering buying a home or renting instead. Each of these considerations will play an important role in determining which housing option is better for you and your family moving forward.

What is your long-term housing plan?

Buying a home is a long-term investment. That said, it’s important to consider where you see yourself in the next 3-5 years before making a decision. Will you still want to be in the same location, or are you planning on moving to a new city? If you’re planning on staying put, that fact alone might make renting a better option. If you plan to move soon, renting is often easier to do than buying because it’s a much more flexible option. If you’re looking to buy a home, on the other hand, you’ll want to make sure you have enough cash saved up. A down payment, closing costs, and associated fees make buying a home a costly investment. That’s why it’s important to consider your long-term housing plan—if you plan to stay in the same location for years to come, buying may be a better option.

How much are you currently paying in rent?

This is a good question to ask yourself when you’re considering buying a home or renting, but it’s also important to consider your current rent amount. The average cost of rent in the U.S. is $1,439, which is a significant monthly expense, and one that doesn’t appear to be going down anytime soon. Rent is generally consistent regardless of which city you live in, which means that your monthly rent payment will likely stay the same or increase over time. Rent is an expense that never goes away, and is something that becomes a part of your standard monthly budget. On the other hand, a mortgage payment is something that will decrease over time as you pay off your principal and interest. Consider how much you currently spend on rent each month, as well as how much you’d likely spend on a mortgage each month. Focus on how these expenses would change as you compare the two options side by side. A mortgage payment will increase over time, but it will do so at a slower rate than your rent would increase.

How much will it cost to buy a home?

This is a good question to ask yourself when you’re considering buying a home or renting, but it’s also important to consider the associated costs of buying a home. The down payment is the amount of money you’ll need to save in order to purchase a home. The average down payment for a home in the U.S. is $24,303. That’s a significant amount of money, and one that may be a challenge for many people to save. If you plan to buy a home with a mortgage, you’ll need to save a down payment and be prepared to pay closing costs. Closing costs are the expenses related to buying a home that can range from hundreds to thousands of dollars, depending on your state and mortgage lender.

What are the ongoing costs of owning a home?

This is a good question to ask yourself when you’re considering buying a home or renting, but it’s also important to consider the ongoing costs of owning a home. Maintenance and repairs are just part of owning a home, and something that every homeowner can expect to deal with at some point. If a roof or water heater breaks, it’s the homeowner’s responsibility to make repairs. In addition to those one-time expenses, there are also recurring costs associated with owning a home. Property taxes, homeowners insurance, and mortgage payments are all costs that can be expected when buying a home. It’s important to consider these costs when deciding whether to buy a home or rent instead.

Are there any benefits to renting instead?

This is a good question to ask yourself when you’re considering buying a home or renting, but it’s also important to consider the benefits of renting instead. Renting is a much more flexible option than owning, and is a great option when you’re unsure about making a long-term commitment. If you’re unsure about the future, you can move on with ease at any time. There are also other intangible benefits to renting instead of buying. For example, you can choose to live in areas where owning a home is much more expensive, like major cities with high-priced real estate, like New York City, where the average home price is $1,000,000. If you’re unsure about making the commitment to buy a home in an expensive market, renting may be the best option for you.

Should you wait before making this decision?

This is a good question to ask yourself when you’re considering buying a home or renting, but it’s also important to consider if you’re waiting for an ideal moment. For example, you may want to wait until housing costs decrease before making the decision to buy a home. Prices have been steadily decreasing since the housing crash in 2007, and while they’ve fluctuated in recent years, there is some forecasted optimism that prices may continue to fall. On the other hand, if you’re keen on buying a home and have been renting for a while, now may be a good time to make the leap. Now is a great time to buy a home because real estate prices are relatively low. Homeowners looking to sell their properties, especially in growing cities, will generally be open to negotiation. Additionally, mortgage rates are at a historical low, making it easier for people to buy a home than ever before.

What are your housing needs and wants?

This is a good question to ask yourself when you’re considering buying a home or renting, but it’s also important to consider your housing needs and wants. Your housing needs are the aspects of a home you must have, like a certain number of bedrooms and bathrooms. Your housing wants, on the other hand, are the extras that you’d like to have, like a two-story house with a pool. If you have a family, you’ll want to consider how many bedrooms you’ll need. You should also think about where you want to live. Do you want to be close to work, or far away? Is there anything else you need or want in a home? It’s important to think about these things, as well as the costs associated with each option, before making a decision.

Are there any benefits to owning a home that might sway your decision?

Owning a home is a long-term investment, and purchasing a home is often a great way to create equity. If the housing market continues to grow and prices rise, you’ll gain equity in the home over time. In other words, you’ll see the value of your home rise, which will make it easier to sell the home in the future. There are also other benefits to owning a home. For example, you’ll likely have lower monthly expenses when compared to renting, and you’ll have more flexibility to make changes to your home. If you’re ready to make a long-term commitment to a home, owning a home may be a great option for you.